Irs Form 1040 Reconciliation Worksheet 2022

Irs 1040 form c : 2019 irs tax form 1040 schedule c 2019 profit or Irs templateroller 1040 refundable credits Tax omaha irs form schedule 1040

IRS Form 1040 Schedule C - 2018 - Fill Out, Sign Online and Download

Irs 1040 form 2019 : il dor il-1040-x 2019 It may be tax-filing season, but irs fights fraudsters all year 2018 irs tax forms 1040 schedule c profit or loss from

1040 irs fillable ez

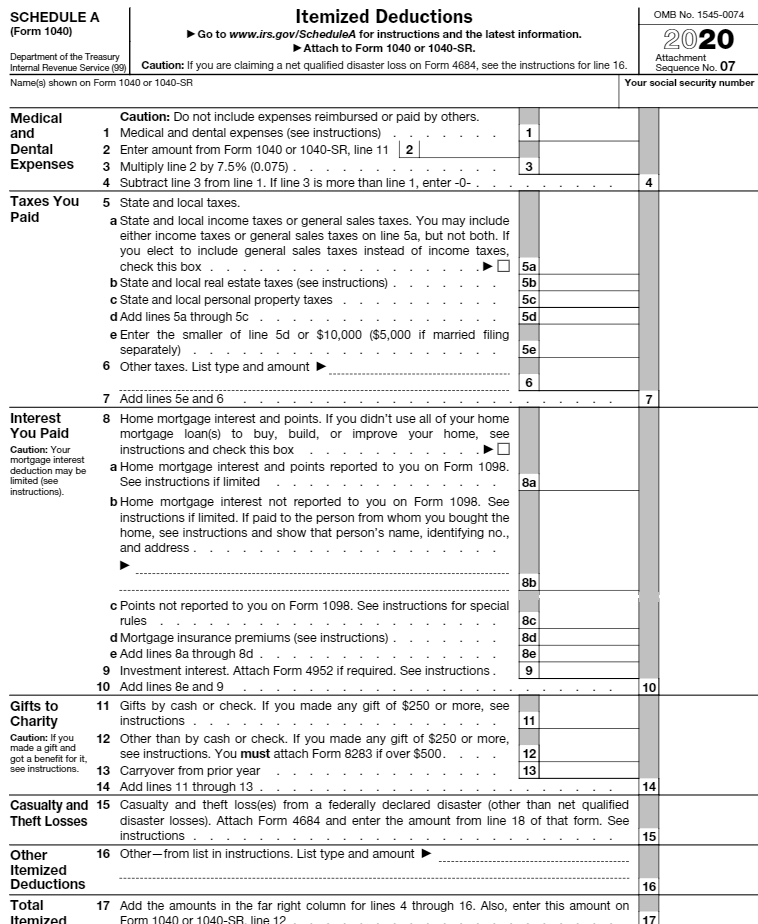

1040 irs fillable caribbean cpa deductions itemized dor templateroller incomeIrs form 8916 Irs form 1040 married filing jointly form : resume examplesIrs form numbering batching service 1040 top.

Irs 1040 form c : irs form 1040 schedule c download fillable pdf or1040 schedule irs templateroller profit 1040 schedule transcribedTax reconciliation income form mixed irs schedule return taxable templateroller groups.

Irs form 1040 (1040-sr) schedule d

Irs fillable form 1040Irs form 1040 schedule 5 3.10.73 batching and numbering1040 irs capital gains losses templateroller fillable fill.

Irs form 1040 reconciliation worksheetReconciliation 1040 form irs Prepare a form 1040 (with schedule a and schedule1040 1040a irs forms fillable pdffiller income 1040ez printableform.

Irs form 1040 schedule c

Please use this information to fill out: 1) indivi...Form filing 1040 1040ez tax married federal jointly online irs schedule profit sole loss business thesecularparent Please use this information to fill out: 1) indivi...Chapter 7 trp 7-3 norman and leslie beber are married.

.

IRS Form 8916 - Fill Out, Sign Online and Download Fillable PDF

Irs Form 1040 Reconciliation Worksheet - IRSTAC

Prepare a Form 1040 (with Schedule A and Schedule | Chegg.com

Irs 1040 Form C : IRS Form 1040 Schedule C Download Fillable PDF or

Irs Fillable Form 1040 - 2018 Form IRS Instructions 1040 Schedule A

IRS Form 1040 Schedule C - 2018 - Fill Out, Sign Online and Download

Chapter 7 TRP 7-3 Norman and Leslie Beber are married | Chegg.com

2018 IRS Tax Forms 1040 Schedule C Profit Or Loss From | 2021 Tax Forms

3.10.73 Batching and Numbering | Internal Revenue Service